In the area of healthcare revenue management, discovering hidden treasures is a vital element to ensure financial sustainability. Similar to explorers who go on a treasure hunt, healthcare companies can set out on a search to improve revenue integrity by implementing audits to capture charges. This article explains the essence of audits to capture charges, highlights the potential hidden gems in your business, and then outlines the steps to implement.

Defining Charge Capture Audits

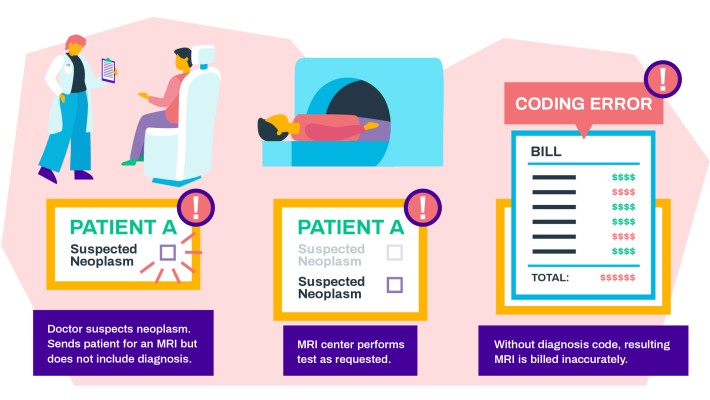

Audits of charge capture are a systematic method that examines healthcare services starting from the point of registration for patients or scheduling to the time of reimbursement. They include thoroughly investigating the various processes associated with the pre-visit preparation process, like patient eligibility and documentation for clinical services and coding charges, charge capture and reconciliation, and reimbursement and billing processes to prevent revenue leakage.

If done correctly, the charge capture audit will reveal hidden gems, enhancing your procedures to ensure compliance with regulations and enhance general financial efficiency.

Benefits of Charge Capture Audits

Charge capture isn’t an area where you can guarantee everything will go according to plan. Healthcare Financial Management Associated (HFMA) discovered that the average medical practice suffers losses of $125,000 annually due to inadequate charge capture procedures.

Furthermore, HFMA reported that, on average, hospitals lose close to 1 percent of charges due to leakage, leading to millions of dollars in revenue lost. There are four primary advantages of conducting these audits:

Revenue optimization

By identifying and correcting errors in charge capture processes, Healthcare organizations can boost the revenue streams they generate and prevent revenue loss.

Compliance adherence

Charge capture audits facilitate payers’ compliance with regulations and guidelines, thus minimizing the chance of compliance infractions and penalties.

Efficiency of operations

Streamlining the process for capturing charges through audits boosts operational efficiency, reduces administrative burdens, and improves overall efficiency.

Improved treatment for the patient

Accurate capture of charges guarantees proper reimbursement for services provided, allowing healthcare professionals to provide the highest standards of patient care without financial limitations.

A Step-by-Step Guide to Charge Capture Audits

Don’t be afraid of charge audits of capture! If you take the proper method, they can be simple to conduct. Here’s a guideline to start:

Find high-risk areas

Take a look at departments that are susceptible to documentation delays or billing problems. Pediatrics, cardiology emergency services, and surgery are all examples. Be sure to focus on areas with significant service volumes or complicated procedures.

Create a map of your current process.

Make a thorough checklist detailing each step of the current charge capture process. This will help you identify problems and guide your audit. The most common mistakes are inaccurate patient information regarding insurance, incomplete evidence, medical code errors, and gaps within billing documents.

Regular Audits are essential

Healthcare constantly changes, so periodic audits (ideally within three days of receiving service) are vital to identify issues early and avoid revenue loss.

Make sure you catch errors early

Frequently check your charge capture procedure (ideally within just a few days after service) to find and correct potential issues before they escalate into more significant problems and revenue loss. Proactive methods are crucial to surviving the ever-changing healthcare industry.

Explore further

After finding areas for improvement, go to the root of the issue. Gather a group comprising experts from IT, finance and billing, coding, and clinical and billing departments. Their insights from all departments will allow you to understand why these issues arise and formulate practical solutions.

Do something about it

Based on your research, make adjustments to strengthen your revenue cycle. This could include securing revenue gaps, streamlining processes, and checking law compliance. Then, conduct a re-audit to determine the impact of your changes.